Disclosures

Search the current disclosures for any issuer name or ticker covered by Barclays Research or any independent research firm whose reports are made available by Barclays.

| Issuer: | Raiffeisen Bank International AG (RBIV.VI) | |

| Coverage Analysts: |

Krishnendra Dubey - Primary Analyst Flora Bocahut | |

| Current Stock Rating/Industry View: | Overweight/Positive |

Disclosures applicable to this issuer:

Important Research Disclosures:

Valuation Methodology: Our valuation methodology is sum-of-the-parts based. Our key assumptions are growth of 1%-2% for individual geographies and a discount rate of 13% and COE of c.15%. We value divisions based on allocated capital and normalised RoCET1 and add excess capital/deficit.

Risks which May Impede the Achievement of the Barclays Research Price Target: Key risks to our price target include:

- Geopolitical risk across the major markets and delay in implementing solutions for the Russia business.

- Market share loss in key geographies owing to competition.

- Delay in execution and release of NGEU and MFF funds.

- CESEE Economic growth is slower than anticipated, resulting in interest rate actions.

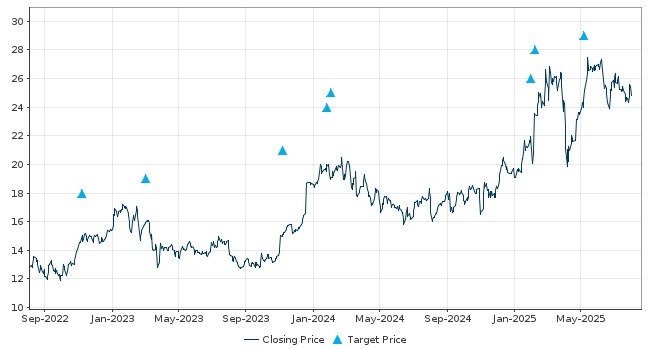

Price Chart:- Geopolitical risk across the major markets and delay in implementing solutions for the Russia business.

- Market share loss in key geographies owing to competition.

- Delay in execution and release of NGEU and MFF funds.

- CESEE Economic growth is slower than anticipated, resulting in interest rate actions.

Source: IDC, Barclays Research

Raiffeisen Bank International AG

Currency=EUR

Below is the list of companies that constitute the "industry coverage universe":